Understanding your taxes is important for managing your money. In Ethiopia, income tax follows a system where the more you earn, the higher your tax rate. This guide will help you understand the Ethiopian income tax rates for 2025 and how they apply to you.

What is the Ethiopian Income Tax System?

Ethiopia uses a progressive tax system. This means that people with higher incomes pay higher taxes. If you earn less, you pay a lower percentage of your income. The idea is to make the tax system fairer for everyone.

Ethiopian Income Tax Rates for 2025

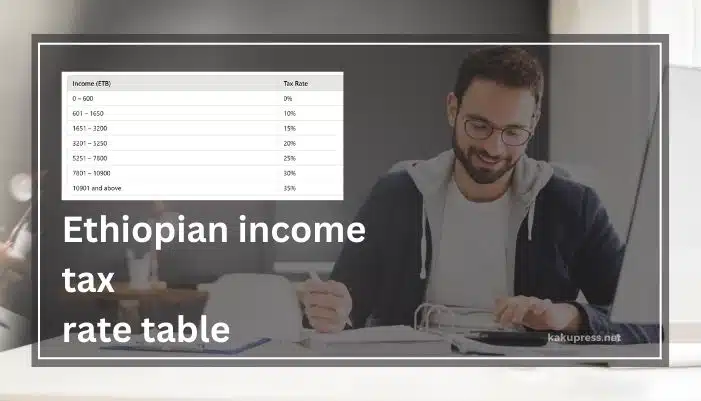

Below is the tax rate table for individuals in Ethiopia in 2025. The table shows how much tax you pay based on your income.

ETB stands for Ethiopian Birr, which is the local currency.

How Does the Tax System Work?

The tax system is progressive, which means that the higher your income, the higher your tax rate. But, the tax rate only applies to the income in each bracket. For example, if you earn more than the lowest bracket, you only pay the higher tax rate on the income above that.

Here’s how the system works:

-

0 – 600 ETB: If you earn up to 600 ETB, you pay no tax. This helps low-income earners.

-

601 – 1650 ETB: If you earn between 601 ETB and 1650 ETB, you pay 10% tax on the amount above 600 ETB.

-

1651 – 3200 ETB: For those who earn between 1,651 ETB and 3,200 ETB, the tax rate is 15% on the income above 1,650 ETB.

-

3201 – 5250 ETB: If your income is between 3,201 ETB and 5,250 ETB, you pay 20% tax on the amount over 3,200 ETB.

-

5251 – 7800 ETB: For earnings between 5,251 ETB and 7,800 ETB, the rate goes up to 25% on the income above 5,250 ETB.

-

7801 – 10900 ETB: If you earn between 7,801 ETB and 10,900 ETB, the rate is 30% on the income above 7,800 ETB.

-

10901 and above: For those earning more than 10,900 ETB, the tax rate is 35% on the income above 10,900 ETB.

Why Is the Ethiopian Tax System Progressive?

The progressive tax system helps make sure that people with more money pay more tax. This way, the government can collect enough revenue for services like education, healthcare, and infrastructure. At the same time, those who earn less don’t have to pay a high percentage of their income.

Key Points to Remember:

- Tax is only applied to income in each bracket. For example, if you earn 3,000 ETB, you only pay 10% tax on the portion above 600 ETB.

- Employers usually handle tax payments. If you work for a company, your employer will withhold taxes from your salary and pay it to the government.

- Self-employed people need to handle their own taxes and may need to file tax returns.

- Tax rates may change over time. Always check for the latest updates or talk to a tax expert if you’re unsure.

Conclusion

Now you know how the Ethiopian income tax system works for 2025. The system is designed to be fair by taxing people based on how much they earn. If you earn less, you pay a lower tax rate, and if you earn more, you pay a higher rate. It’s important to understand these tax brackets to manage your finances well.

If you need more help with taxes, consider talking to a tax professional or contacting the Ethiopian Revenue and Customs Authority.