Obtaining a MasterCard in Ethiopia is a straightforward process that can significantly ease your financial transactions, both domestically and internationally.

Whether you’re looking to make online purchases, travel, or simply manage your finances more effectively, having a MasterCard can be beneficial. Here’s a comprehensive guide on how to get one.

1. Choose the Right Bank

Not all banks in Ethiopia issue MasterCards, so your first step is to choose a bank that does. Some of the most reputable banks offering MasterCard services include:

It’s advisable to compare the services and fees associated with each bank’s MasterCard offerings to determine which one best suits your needs .

2. Open a Bank Account

If you don’t already have an account with your chosen bank, you will need to open one. To do this, you typically need to provide:

- A valid government-issued ID (like a national ID or passport)

- Proof of residence (e.g., a utility bill)

- Recent passport-sized photographs

Some banks may also require a minimum deposit to open an account .

Types of MasterCard in Ethiopia

- Debit MasterCard

- Purpose: Linked directly to a user’s bank account.

- Usage: Funds are deducted immediately upon transactions.

- Availability: Offered by major Ethiopian banks like Dashen Bank, Abyssinia Bank, and Commercial Bank of Ethiopia.

- Ideal For: Everyday transactions, online shopping, and ATM withdrawals.

- Prepaid MasterCard

- Purpose: Requires loading funds in advance.

- Usage: Used only up to the preloaded amount.

- Availability: Often used for travel, online purchases, or gifting.

- Ideal For: People who don’t want to link their card to a bank account or need budget control.

- Credit MasterCard

- Purpose: Allows borrowing up to a credit limit set by the issuing bank.

- Usage: Payments are made later, typically with interest if not paid in full by the due date.

- Availability: Limited availability in Ethiopia due to local banking regulations, though some banks may offer it to premium customers.

- Ideal For: Building credit history, emergency expenses, and large purchases.

- Business/Corporate MasterCard

- Purpose: Designed for businesses to manage expenses.

- Usage: Helps streamline expense reporting and control employee spending.

- Availability: Offered by select banks for corporate clients.

- Ideal For: Businesses requiring expense management tools.

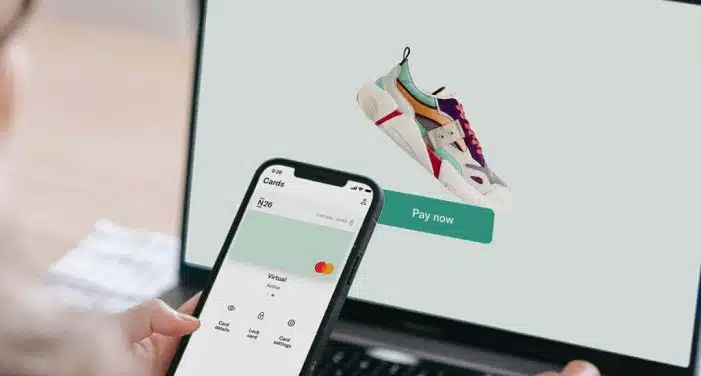

- Virtual MasterCard

- Purpose: Digital card for online transactions.

- Usage: Offers a secure way to shop online without a physical card.

- Availability: Issued by fintech services and some local banks.

- Ideal For: Secure online purchases.

Differences Between Mastercards

| Feature | Debit MasterCard | Prepaid MasterCard | Credit MasterCard | Business MasterCard | Virtual MasterCard |

|---|---|---|---|---|---|

| Linked Account | Yes (Bank Account) | No | No | Yes (Corporate Account) | No |

| Spending Limit | Bank Account Balance | Preloaded Funds | Credit Limit | Business Set Limit | Preloaded Funds |

| Credit Option | No | No | Yes | No | No |

| Target Users | Individuals | Individuals | Individuals | Businesses | Online Shoppers |

| Physical Card | Yes | Yes | Yes | Yes | No |

3. Complete the MasterCard Application

Once your bank account is established, you can apply for a MasterCard. This usually involves filling out an application form, which can often be completed online or at the bank branch. You might also need to provide:

- Income statements (for credit cards)

- Any other documents as required by the bank

Be sure to check if there are any application fees .

4. Await Approval

After submitting your application, the bank will process it. This may take anywhere from a few days to a couple of weeks, depending on the bank’s policies. They will review your credit history and other factors before granting approval .

5. Activate Your Card

Once you receive your MasterCard, you will need to activate it. This can typically be done via the bank’s online platform, mobile app, or by calling customer service. Activation is crucial as it allows you to start using the card for transactions .

6. Understand Fees and Usage

Be mindful of the various fees associated with using your MasterCard. Common fees include:

- Annual fees

- Transaction fees (especially for foreign purchases)

- ATM withdrawal fees

Managing these fees effectively will help you maximize the benefits of your MasterCard .

Read More:

How to Create a Telegram Channel: A Complete Step-by-Step Guide

Conclusion

Having a MasterCard in Ethiopia can open up a world of financial possibilities. By choosing the right bank, completing the application process, and understanding the associated fees, you can take full advantage of this financial tool. For more detailed information, check out the following resources:

- Ethiopia Realty

- Ethiopian Banks

By following these steps, you can enjoy the convenience and flexibility that comes with having a MasterCard in Ethiopia.