The way you handle your money has changed completely because of mobile banking. You no longer have to visit the bank or wait a long time at an ATM. Today, your bank is always with you, right in your pocket. Commercial Bank of Ethiopia (CBE) leads this change with its powerful and simple CBE Mobile Banking app.

This simple guide shows you exactly how to take control of your money using the CBE mobile app. You will learn how to sign up, see the main things the app does, and handle your daily money tasks fast and safely.

What is CBE Mobile Banking?

CBE Mobile Banking is the official application made by the Commercial Bank of Ethiopia. It gives you a safe, digital door to use almost all the bank services you need without going to a physical building.

Think of it like having a small bank branch that is open all day and all night. You manage your money when you want to, not just when the bank is open. The app works on both Android and iOS phones, so most CBE customers can use it.

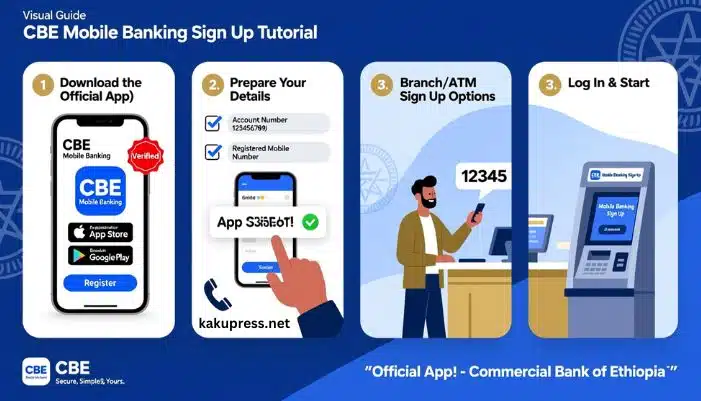

Getting Started: How to Sign Up for CBE Mobile Banking

Before you can use the app, you need to sign up. This is simple for everyone who already has a CBE account.

Step 1: Get the Real App

First, you must download the correct app. Search for “CBE Mobile Banking” on the Google Play Store (for Android phones) or the Apple App Store (for iPhones). Make sure the app is the official one made by Commercial Bank of Ethiopia. Using a fake app is very dangerous for your money.

Step 2: Get Your Info Ready

You will need your CBE account number and the mobile phone number you gave to the bank. This phone number must be the one you told the bank to use for alerts and banking messages.

Step 3: Ways to Sign Up

CBE gives you a few ways to sign up for mobile banking, depending on what is best for you.

Option A: Sign Up Yourself on the App

Many people can sign up right on the mobile app.

-

Open the CBE Mobile Banking app.

-

Look for the Register or Sign Up button.

-

Type in your CBE Account Number.

-

Type in your registered Mobile Phone Number.

-

The bank system will send a text message code to your phone.

-

Type this code into the app.

-

Create a strong password and a Transaction PIN. This PIN is different from your password and you need it to send money or make payments.

-

Check your details, and you are done signing up.

Option B: Sign Up at a Bank Branch or ATM

If you cannot sign up yourself, or if you want help, visit your nearest CBE branch or a CBE ATM that offers this service.

-

Bank Branch: Talk to a bank worker. They will help you through the process, check who you are, and turn on the service for you right there.

-

ATM Sign Up: Some CBE ATMs let you sign up for mobile banking right on the machine. Look for the Mobile Banking or Sign Up choice. Follow the simple directions on the screen to link your account and phone number.

Step 4: Log In and Start

After you sign up, use your User ID and the password you made to log in. You are now ready to handle your money anywhere.

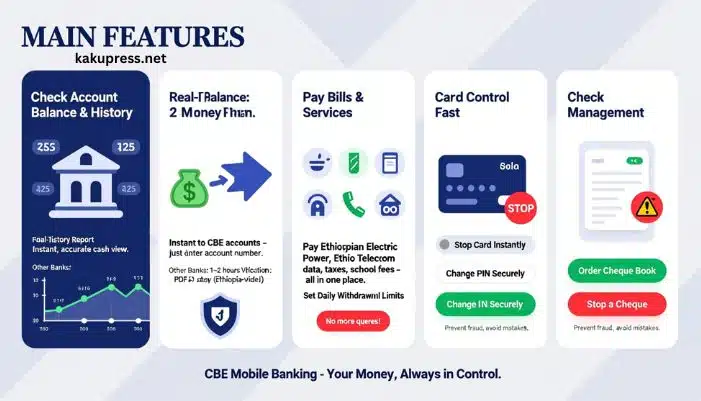

Main Things You Can Do with the App

The CBE Mobile Banking app offers a full list of services that mean you do not need to visit a bank branch for normal money tasks. You have instant control over your cash.

1. Check Account Balance and History

This is the most basic thing you can do. You can check the exact amount of money in all your CBE accounts, including checking, savings, and loan accounts.

-

Real Time Balance: See an instant and correct number of the money you have right now.

-

Recent Moves: See a fast summary of the things you did most recently with your money.

-

Full History: Ask for and download a full report of all your money moves for a certain time. This helps you plan your spending.

2. Send Money Fast

Sending money to others is one of the most useful parts of the app. The app makes these transfers quick and safe.

-

Your Accounts: Move money between your own CBE accounts (for example, from your savings to your checking).

-

To Another CBE Account: Send money to any other person who banks with CBE instantly. You only need the receiver’s account number.

-

To Other Banks: Send money to accounts at other banks in Ethiopia. This may take a little longer to finish.

When you send money, you must type in the correct receiver’s account number and your Transaction PIN to say that the move is okay. This check with two steps keeps your money safe.

3. Pay Bills and Services

Pay your monthly bills directly from the app. This saves you a lot of time and work.

-

House Bills: Pay for things like electricity (Ethiopian Electric Power) and water directly.

-

Phone Payments: Add money to your mobile phone (Ethio Telecom) or buy internet data for yourself or other people.

-

Government Fees: Handle certain taxes or government payments without going to an office.

-

School Fees: Pay for school or college fees for your children at schools that use this service.

4. Card Control

You can manage your ATM and debit card settings right inside the app. This makes your cards safer and gives you more control.

-

Stop Card: If your card is lost or someone steals it, you can quickly block it in the app. This is much faster than calling the bank and stops anyone from using your money.

-

Change PIN: Safely change the PIN you use at the ATM.

-

Money Limits: See or change how much money you can spend or take out each day with your card.

5. Check Management

For businesses or people who use paper checks, the app has simple tools.

-

Ask for Cheque Book: Easily order a new book of checks. The bank will get it ready for you to pick up at your branch.

-

Stop a Cheque: Stop a payment on a specific check that you wrote, which helps prevent mistakes or fraud.

Safety First: Keeping Your Account Safe

Since your phone gives access to your money, keeping it safe is very important. CBE uses many layers of protection, but you must also help.

-

Strong Codes: Make a unique, hard-to-guess password for logging in to the app. Use a separate, easy-to-remember Transaction PIN just for saying yes to money moves. Never share these codes with anyone.

-

Use Fingerprint/Face ID: If your phone allows it, use your fingerprint or face to log in. This is often the safest and quickest way to open the app.

-

Log Out When Done: Always sign out of the app when you finish your work, especially if you share your phone with others.

-

Only Use the Real App: Get the app only from the official Google Play Store or Apple App Store. Do not use links or websites you do not trust.

-

Update Your App: Always use the newest version of the CBE Mobile Banking app. Updates often fix safety problems and add new tools.

CBE will never call or email you to ask for your password, PIN, or full account details. Be careful of any message that asks for this information.

Better Ways to Use the App

You can use the CBE app for more than just sending money. Here are a few smart ways to use the service well.

Pay Bills on Time

If you have a bill you must pay every month, like rent or a loan payment, you can often set up a scheduled payment inside the app. This means you will never forget to pay on time.

Find the Nearest Bank or ATM

If you are in a new place, the app can use your phone’s GPS to show you where the closest CBE branch or ATM is. This saves you time searching.

Get Help Easily

If you have a problem or a question, the app usually gives you direct ways to contact CBE for help. This includes phone numbers and emails. You can often call the customer service line right from the app.

Read: Sabaaf App: Simple Steps to Win in Online Business and Tech

Conclusion

CBE Mobile Banking gives you great ease and control. It removes the stress of having to fit your day around the bank’s opening hours. By following the sign up steps and using the safety rules, you get a powerful tool that puts your money right into your hands.

Your time matters. Use the CBE mobile app to save time and manage your money well from anywhere you are.

Questions and Answers (FAQs)

Q1: Is CBE Mobile Banking safe to use?

A: Yes, CBE Mobile Banking is very safe. It uses special codes to protect your information. Also, you must use a login password and a separate Transaction PIN to approve any money moves. This two step safety check is very strong. Just remember to never share your codes.

Q2: Does it cost money to use the CBE Mobile Banking service?

A: The Commercial Bank of Ethiopia usually lets you sign up for mobile banking for free. However, some specific things you do, like sending money to another bank or paying certain bills, might have a small fee. You should always check the bank’s fee list on their website or in the app.

Q3: What should I do if my phone is lost?

A: If your phone is lost or stolen, you must call the Commercial Bank of Ethiopia customer service line right away. They can quickly stop access to your mobile banking account until you get a new phone.

Q4: Can I use the CBE Mobile Banking app without internet?

A: No, the CBE Mobile Banking app needs a good internet connection (either phone data or WiFi) to talk to the bank’s computers and finish your transactions in real time. For simple tasks that do not need internet, like checking your balance by text message, you might need to use the bank’s separate USSD service.

Q5: I forgot my Transaction PIN. How can I get a new one?

A: If you forget your Transaction PIN, you usually cannot reset it on the app alone because of safety rules. You may need to visit your nearest CBE bank branch so they can check who you are and help you get a new PIN. This is the surest way to solve a forgotten PIN problem.